Introduction

While there are many important financial decisions in life, securing the proper life insurance is among the most significant. Life insurance provides financial protection for loved ones by paying out a death benefit to beneficiaries. This can help cover final expenses, debts, income replacement, college tuition and more. However, with so many policy options to choose from, selecting the right type of coverage can seem overwhelming.

In this blog post, I hope to untangle some of the complexity around life insurance choices and provide a helpful overview of the main policy types. My goal is to explain the options in an accessible way so readers feel empowered to make an informed selection best suited to their unique needs and situation. While every policy has tradeoffs to consider, with the right information, choosing life insurance need not be stressful or confusing.

Let’s get started unraveling the options!

Term Life Insurance

Term life insurance is one of the most basic and affordable types of coverage. As the name implies, term policies are only in effect for a predetermined period of time, commonly 10, 20 or 30 years. The main benefits of term insurance are its relatively low cost compared to other policies and the flexibility it provides.

How does it work? With term insurance, you are only covered during the policy term. For example, if you purchase a 20-year term policy, you will be covered for 20 years. As long as you maintain your payments, the death benefit will be paid out to beneficiaries if you pass away during that time period. However, once the term ends, coverage expires and your beneficiary would receive nothing.

Term policies do not build any cash value like some other types. The entire premium goes toward life insurance protection for the duration of the term. Essentially, you are pre-paying for coverage during the years when premature death would likely cause hardship for loved ones.

Cost is the primary advantage. Due to only providing coverage temporarily, term policies are significantly more affordable than permanent plans in the short-run. This allows you to secure higher death benefit protection for less money upfront compared to other types of policies.

Term is a popular choice for individuals looking for basic death benefit protection at minimal cost. It also works well if needs are time-sensitive, such as coverage during child-rearing years or while paying a mortgage. The lack of cash value build up means all premium dollars go toward providing insurance, not savings.

However, there are some important considerations with term. Without cash value build up, term offers no savings component. Coverage expires at the end of the term unless renewed, and premiums usually substantially increase each time. So its important to plan for this long-term if choosing term for long protection periods.

Overall, low-cost term life insurance offers good short-term protection needs, but lacks the permanent death benefit and cash value components of other policy types discussed below.

Whole Life Insurance

Whole life insurance, also known as ordinary or straight life, is a type of permanent life insurance policy. Unlike term that expires, whole life provides lifetime coverage as long as premiums are paid. The key features that differentiate it from term are:

- It provides lifelong protection. Coverage remains in effect for as long as you maintain premium payments – there is no time limit like term insurance.

- It builds cash value over time. A portion of each premium funds an cash value account within the policy that grows tax-deferred. This acts as an investment and savings component in addition to the pure insurance.

- Coverage and premiums remains level. The death benefit and premium amount you select at purchase will remain fixed for life, providing predictable costs.

- Cash value can be accessed. Policyholders have access to policy loans and withdrawals from the built up cash value for emergencies or other needs.

Whole life may cost more than comparable term coverage up front since it provides these lifetime elements. However, it costs less over the long run compared to renewing short-term term plans multiple times. The added cash value also gives it an investment facet – the internal rate of return averages around 4-6% historically.

For individuals seeking permanent lifetime coverage who also value the savings/investment component, whole life strikes a great balance. The trade off is higher premiums than purely cost-driven term policies. It works well for clients looking for guaranteed coverage and interest rates for decades to come.

Universal Life Insurance

Universal life, or UL, is a flexible type of permanent coverage that gained popularity in the 1980s as an alternative to whole life policies. Like whole life, it provides lifelong protection as long as premiums are paid. However, it differs in some key areas:

- Flexible premium payments. Unlike the fixed premium structure of whole life, UL allows policyholders to pay more or less within certain limits and minimums each year. This provides payment flexibility.

- Fluctuating cash value interest. The interest rate credited to the cash value portion is not fixed like traditional whole life. It can vary frequently with market conditions.

- Flexible death benefit. In addition to flexible premiums, the death benefit amount can also be increased or decreased to meet changing needs over time.

- Lower long-term costs typically. With its adjustable premiums and interest rates linked to economic trends, UL can potentially be more cost effective than whole life over decades.

The tradeoff is less stability and predictability compared to whole life. Interest credits, premiums and coverage amounts can fluctuate. UL requires more proactive management to realize cost savings versus the set-it-and-forget-it nature of whole life.

Overall, universal life strikes a balance between flexibility and permanence. It works well for clients seeking coverage that can adapt to financial situations that may change over many decades. Just requires a bit more hands-on oversight compared to straight whole life policies.

Variable Life Insurance

Variable life takes the adjustable elements of universal life a step further. Like UL, it provides lifelong death benefit protection through a permanent policy. The key difference is how the cash value portion is structured:

- Cash value invested in the market. The non-insurance portion of premiums go into a separate investment account within the policy, providing exposure to equity and bond mutual funds just like a 401k or brokerage account.

- Investment performance directly impacts cash value. Market gains and losses are passed directly through to the policy’s internal value. This means it has potential for higher long-term returns but also subjects the cash to volatility and risk of losses.

- Death benefit floor provides some downside protection. Even if investment losses occur, the death benefit has a minimum floor to ensure some protection is always provided. However, this floor level may be lower than the face value during market downturns.

The upside is participation in stock and bond market returns has capacity for higher long-term growth of internal cash values versus fixed policies. Whereas whole and universal life are limited by conservative crediting rates set by the carrier.

That said, variable life also requires more investment management and exposes policyholders to direct market risk that fixed policies avoid. Cash values have potential to lose value in downturns if not properly diversified.

In summary, variable life marries permanent death benefit protection with an investment account structure for those comfortable taking on market linked risk within their life insurance.

Indexed Universal Life Insurance

During the last few decades, a newer hybrid product has emerged combining attributes of UL and variable life – indexed universal life insurance, or IUL for short. It works as follows:

- Interest credits linked to an index. IUL policies credits interest based partially or entirely on the performance of a market index like S&P 500. This provides potential upside similar to variable life.

- No direct equity investment. However, the policyowner does not directly invest in the market or mutual funds like variable life. It only tracks/partially participates in an index.

- Minimum floors provide some downside protection. Even during years where the index performs poorly or negative, the interest rate credits to IUL cash values have minimum floors. Unlike variable life, internal values have less risk of loss.

- Adjustable premiums, death benefit and crediting strategy flexibility. Like traditional UL, premium amounts, coverage levels and even the indexes/crediting methods used can typically be altered over time for adaptable protection.

Indexed UL aims to capture some upside potential of equity-like returns while avoiding direct market exposure risks. Downside protection floors provide greater stability than variable policies. It has grown in popularity as a balanced “middle ground” product.

Of course, participation in index gains will still be partially limited versus direct equity investments. And long term returns may still lag the broader market in various economic cycles. Overall though, IUL offers policyholders more upside growth opportunity than fixed policies with less risk than variable. A great option for those interested in balanced growth and protection.

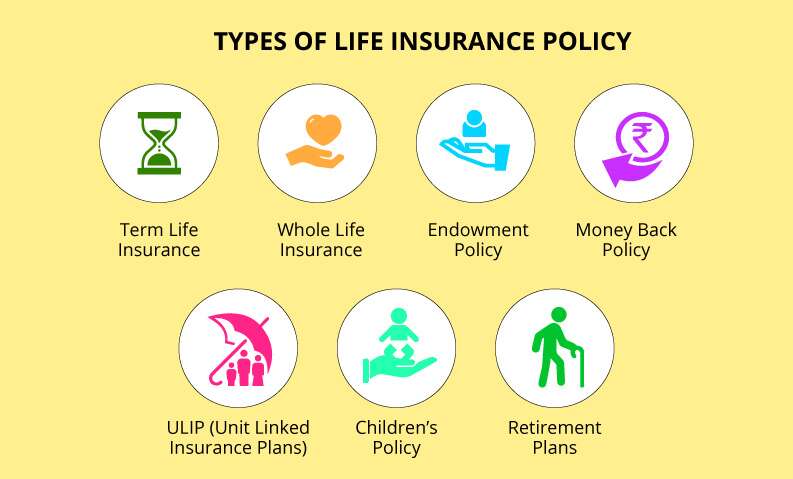

Summary of Main Policy Types

To summarize the different policy types in a quick reference format:

- Term Life: Low-cost temporary coverage for a predetermined period, no cash value build up. Best for short-term needs.

- Whole Life: Lifelong permanent coverage, level premiums, stable cash value growth at modest rates typically around 4-6%. Planned long-term coverage and savings.

- Universal Life: Permanent flexible coverage, adjustable premiums and coverage amounts, cash value interest credit rates may fluctuate. More adaptability but requires monitoring.

- Variable Life: Permanent policy, cash values directly exposed to market performance in separate investment account. Highest long-term growth potential but also market risk.

Comments

Thank you for writing this article. I appreciate the subject too.

Thank you for writing this post!

You helped me a lot by posting this article and I love what I’m learning.

Can you write more about it? Your articles are always helpful to me. Thank you!

May I have information on the topic of your article?

The articles you write help me a lot and I like the topic

The articles you write help me a lot and I like the topic

Please provide me with more details on the topic

Your articles are very helpful to me. May I request more information?

You’ve the most impressive websites.