Introduction

When it comes to life insurance, most of us are familiar with the basic idea – you pay regular premiums to an insurance company in exchange for them paying your loved ones a lump sum if you die within the coverage period. However, understanding exactly how life insurance premiums are calculated can seem complex and shrouded in mystery.

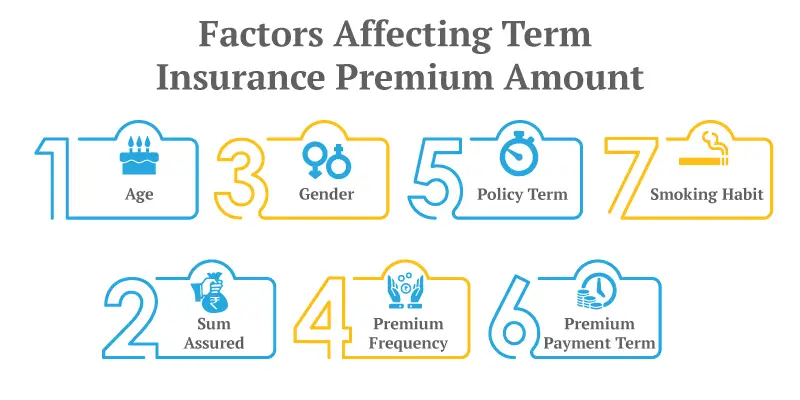

The truth is, many different factors impact your life insurance rates, from straightforward considerations like your age and health status, to more nuanced things like occupation and avocations. By gaining a clearer picture of the keys that unlock life insurance pricing, you can make savvier choices to optimize your coverage for your unique needs and budget.

In this article, I’ll walk through the major variables that determine what you’ll pay for a policy and explain how each factor influences premium costs. My goal is to shed light on this often opaque subject and empower you with knowledge to find high-quality protection at a fair price. By the end, you’ll have a solid understanding of what really shapes premium pricing behind the scenes.

Let’s get started unlocking the secrets to optimal coverage!

Age

Of all the factors affecting life insurance premiums, your age is arguably the most significant. That’s because age is strongly correlated with mortality risk – the likelihood of dying within the coverage period based on actuarial data. Generally speaking, the younger and healthier you are, the lower your risk of passing away sooner rather than later.

The relationship between age and insurance rates follows a predictable pattern:

- Ages 20-30: Premiums are quite low during these early adult years because statistically, few people in their 20s or lower 30s die each year relative to later decades. Insurers view young applicants as very good risks.

- Ages 30-50: Rates increase gradually as risks rise with each additional year. Mortality starts to pick up a bit more in this age bracket compared to one’s youth.

- Ages 50-60: Premium hikes accelerate due to higher death rates in these median adult years according to statistics. Insurers perceive applicants in their 50s as greater risks than younger demos.

- Ages 60+: Premiums skyrocket for senior applicants, growing much steeper with each additional year of age. Advanced age translates to exponentially higher mortality danger in insurers’ eyes.

To quantify it, a healthy 30-year-old could expect to pay 20-40% less than a 40-year-old for the same $1 million policy. And that 40-year-old would enjoy rates 40-60% below those of a 60-year-old counterpart. Age is absolutely mission-critical to premium size.

Gender

In line with actuarial mortality tables, women generally receive better insurance pricing than men due to longer expected longevity. Recent decades have shrunk the gap as women’s lives have become almost as risky as men’s regarding some causes of death like cancer and heart disease. Still, gender remains a premium rating factor.

On average, a 45-year-old man could pay 5-15% more than a same-aged woman for an identical permanent life insurance policy, given equal health profiles otherwise. The divergence grows more dramatic after age 50 and into seniors’ brackets, where male applicants may face premium dues 20-30% higher than female counterparts.

Insurers impose these price loadings because statistically, men succumb to fatal illnesses and accidents at higher frequencies than women according to population-wide records. For example, heart attacks affect men at about double the rate of women. Longer projected lifespans for females translate to cheaper life coverages.

Health Status

Your current state of health and lifestyle plays a huge part in premium pricing, second only to your age. Carriers want to understand your medical history, any preexisting conditions, family history, habits like smoking, BMI, and more to quantify underwriting risk. Superior wellness lowers rates; serious conditions mean higher premiums or declined applications altogether.

Generally healthy non-smokers usually enjoy the most competitive pricing, while those with chronic illnesses or risky behaviors inevitably pay more or confront limited options. Some examples of health factors’ influence:

- Diabetes: Rates may rise 25-50% compared to a diabetic-free applicant of the same stats. The longer one has had the disease, the costlier it becomes.

- High Cholesterol: Has less impact than diabetes but still could mean 15-30% rate hikes versus identical profiles lacking this condition.

- Smoker: Smoking drives up premiums dramatically, often 50-100% or more higher than non-tobacco users. The longer and more one has smoked, the pricier.

- Obesity: Carrying excess pounds might incur small 5-15% surcharges relative to healthier weights given equal profiles otherwise.

- Family History: A parent or sibling’s early heart disease or cancer could result in 10-30% markups versus applicants with no such heritage.

Medical advances and healthy behaviors let many manage past health issues. But from insurers’ risk perspective, prior or current care outweighs future uncertainties, cementing health status as a core premium determinant. Understanding risks empowers better matches with carriers.

Occupation

The demands and hazards of different jobs factor into a applicant’s insurability and rates as well. More physically taxing or statistically riskier professions usually equate to higher life coverages costs versus safer or sedentary work categories.

Here’s a sampling of how occupation can potentially raise or lower rates:

- Construction Worker: May see premium increases of 15-30% compared to similar office professionals due to accident potentials on construction sites.

- Police/Firefighter: Given life-threatening duties, cops and firefighters often face 25-50% premium markups versus average jobbing civilians.

- Commercial Pilot: Risky duties means aircrew frequently pay 50-100% more than ground-bound peers for equal profiles in all other ways.

- Medical Doctor: Relatively sedentary work and higher education may shave 5-15% off rates relative to blue-collar applicants.

- Accountant: Low-risk office job carries no inherent premium surcharges versus average citizens.

Underwriters strive for fair treatment of all careers. But statistically riskier occupations necessitate some price adjustments to retain profitable pooling of mortality threats. Understanding ratings for various jobs aids coverage selection.

Amount of Coverage

The greater the face value amount you insure, the higher your life insurance premiums will typically be. There are a few reasons for this:

- Administrative Expenses: Issuing and maintaining larger policies incurs more paperwork, medical exams, record-keeping costs for insurers to shoulder.

- Investment/Reserving Requirements: Higher coverage sums mean insurers must allocate more investment capital upfront in reserves against payout promises. That requires charging higher premium yields.

- Risk Factors: Statistically speaking, the probability of dying and triggering a $5 million payout is less than dying and causing a $1 million benefit to be paid out.

As an example, doubling your coverage from $500,000 to $1 million could raise your premiums by 10-20%, while increasing from $1 million to $2 million may drive rates up 15-30% relative to maintaining the lower amount, assuming equal profiles otherwise. Higher-sum policies logically demand steeper premium investments.

Length of Coverage Term

The period for which you purchase life insurance protection also impacts what you pay:

- Term Life Insurance: Shorter terms like 10-year or 20-year result in lower premiums than 30-year coverage durations, which are cheaper than securing protection to age 65, 80 or beyond. The longer one locks in rates, the costlier premium installments become.

- Permanent/Whole Life Insurance: These provide lifetime coverage but their premiums don’t rise with age like term. Instead, you pay an equivalent yearly rate that remains level over time. Premiums are higher upfront than short-term term policies but provide lifelong protection without rate increases.

All else equal, securing a 30-year $250,000 policy may command premiums 25-50% above a similar 10-year term plan. Choosing coverage length helps balance protection needs with budget. Understanding relationship to rates assists smart choices.

Payment Frequency

Whether you opt to pay life insurance premiums monthly, quarterly, semi-annually or annually also has an influence, albeit a small one, on your overall costs:

- Monthly Premiums: Paying miniature installments 12 times a year results in marginally higher total costs than larger lump payments less often throughout the year. This is because choosing monthly option adds on extra billing administration fees.

- Annual Premiums: Opting to pay in one annual lump disbursement proves the cheapest method as it avoids per-period surcharges and allows maximum time for money to accrue investment returns inside the premium pool.

In general, annual premium payments can shave 1-5% off total costs versus monthly installments. Quarterly and semi-annual frequencies fall in between the monthly-annual spectrum. The convenience must be weighed against minor dollars saved choosing less frequent intervals.

Availability/Insurability

Sadly, not everyone can access comprehensive or affordable coverage depending on individual insurability issues. Those facing diminished insurability or coverage restrictions may experience:

- Limited Policy Options: Health woes, risky jobs or lifestyles could leave only basic whole/term choices instead of premier carrier selections and riders.

FAQs

How much more will I pay if I’m overweight?

Being overweight or obese can increase your life insurance premiums, but the impact depends on several factors. If your BMI is 30 or higher, you may see rates go up slightly by 5-15% compared to a similar policyholder who is a healthy weight. However, it also comes down to things like your overall health profile, family history, and any weight-related conditions. For instance, someone carrying extra 50 pounds may pay only a small surcharge if they’re otherwise very healthy, while a severely obese applicant with diabetes or heart issues would see much higher rates. Overall fitness matters more than pounds alone, so working to improve your health can offset some weight penalties over time.

Will getting in better shape lower my premiums later?

Yes, proactively improving your health through lifestyle changes like losing weight, quitting smoking, or better managing chronic conditions can absolutely help reduce insurance rates down the road. Carriers reward healthy behaviors with pricing adjustments during renewal underwriting reviews every 2-5 years. So maintaining or upgrading your wellness demonstrates lower risk to insurers, sometimes resulting in premium decreases of 5-20% or even better coverage options opening up. Documenting health progress through doctor checkups and labwork helps support requests for rate reductions later. Taking steps now to get healthier pays long-term dividends on future insurance costs.

How long do health issues or risky jobs affect rates?

The impact of prior health problems or hazardous occupations on insurance rates depends on stability and severity. Minor issues or past conditions well controlled for many years may have little impact. But significant health woes or risky jobs triggering major premium hikes within the past 5 years usually mean those penalties gradually decline over 5-10 years as health or employment situation demonstrates sustained improvement. For very high-risk histories within the past couple years, full penalties may remain longer. Carriers balance acuity, longevity and permanence of lifestyle changes when deciding how long to assess conditions during underwriting and renewals. Overall transparency on application forms lets them properly adjust pricing over time.

Does it matter if I smoke occasionally vs daily?

Yes, there is an important distinction – daily smoking drives up life insurance premiums dramatically more than just occasional use. For example, a social smoker who lights up only a few times per month when socializing may see rates 10-20% above non-smokers. Meanwhile, a one-pack-per-day habit translates to 50-100% or higher premium increases versus non-tobacco users. Insurers view consistent daily smoking as indicating a much higher health hazard level long-term based on medical data linking it to many chronic illnesses and earlier death. Frequency impacts underwriting decisions substantially, so fully disclose usage patterns honestly.

If I quit smoking, how long before rates reflect it?

Most carriers will provide premium discounts for successful smoking cessation within the past 12 months. However, the degree of savings depends on several factors, including how long and how heavily you smoked previously as well as health markers like bloodwork showing improved circulation. A light, former smoker may get rate reductions materializing within 2 years. But an ex-heavy smoker may take 5 years of non-smoking plus healthy tests before realizing full non-tobacco user cost benefits. Be patient – insurers want to see sustained abstinence lowering risks over the long haul before restoring rates to optimal non-smoker levels. Honesty ensures fair treatment.

What affects rates more – age or health issues?

Generally speaking, age is the most powerful rating factor in life insurance because it broadly captures overall mortality risk trends that increase predictably with each year. However, significant health problems can override age impacts dramatically by placing applicants in higher risk categories. For example, a 30-year old with well-managed diabetes may pay rates similar to a 50-year old with no health issues. Similarly, morbid obesity or other major issues at any age can increase premiums beyond what advanced age alone would produce. Good health habits help counter some age penalties and unlock lower pricing brackets. But nothing trumps actuarial mortality more than present medical concerns.

Conclusion

Understanding the complex interplay between age, gender, health, occupation, coverage amount, term length and payment frequency is key to optimizing life insurance protection affordably and sustainably. Small lifestyle adjustments like exercise, better nutrition, avoiding tobacco and moderating risks yield dividends through lower premiums or better coverage access long term. Overall, transparency helps carriers appropriately rate individuals based on unique profiles so everyone can tap suitable life protection equitably regardless of personal circumstances. With knowledge, policyholders can make informed choices tailoring insurance to shifting needs and budgets throughout life’s seasons.

Comments

You’ve been great to me. Thank you!